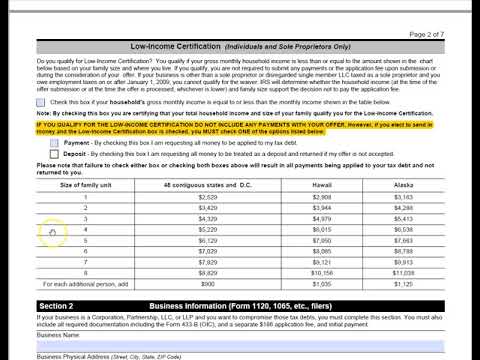

This is Amanda Kendall the true result tax professionals wanted to come onto today and give you a video on the updated form 656 for the offer and compromise these forms are updated almost annually by the IRS there's typically only a few changes, but I wanted to go ahead and point out what the changes were for the form update in March 2018, so I'm going to drop a link below that will get you to the original step-by-step instructions that will carry you through most of this form and then as they're going through that, and you see some differences on this form you'll want to come back to this video to find the differences to know how to fill those out, so I'm going to scroll down here. The application previously was six pages long now it is seven pages long, so I'm just gonna kind of scroll down all of this on this first page here is very similar to the last form. And I've highlighted the sections that we're going to take a look at today so on page two of seven we have our low-income certification which was on the previous form however this highlighted section here is new on the 2018 version of this form. It does state here that if you qualify for the low-income certification that you do not include any payments with your offer however if you do choose to send in some payments on this you have to check one of these boxes in order for that payment to be applied properly. The two options here are either payment or deposit. Let me explain the difference on those. A payment is that you're going to make this payment and whether your offer is accepted you are allowing that payment to be applied to your past...

PDF editing your way

Complete or edit your irs oic forms anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export l compromise directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 656 offer in compromise as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your offer in compromise form 656 l by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 656-L

About Form 656-L

Form 656-L is a form used by taxpayers who want to apply for an Offer in Compromise (OIC) with the Internal Revenue Service (IRS). An OIC is a program offered by the IRS that allows eligible taxpayers to settle their tax debt for less than the full amount owed. The 656-L form is specifically designed for taxpayers who are applying for an OIC based on Doubt as to Liability (DATL), which means that the taxpayer is disputing the amount of tax owed or whether they are even responsible for the tax debt. To be eligible for this program, taxpayers must complete and submit Form 656-L along with other required documents and fees. The form includes detailed information about the taxpayer's finances, including income, expenses, assets, and liabilities. It also requires the taxpayer to provide a detailed explanation of their dispute with the IRS over the amount of tax owed or their liability for the tax debt. In summary, taxpayers who cannot pay their tax debt in full and are disputing the amount owed or their liability for the debt may need to use Form 656-L to apply for an OIC based on DATL with the IRS.

What Is irs gov form 656?

Online technologies make it easier to organize your document management and boost the efficiency of your workflow. Look through the short tutorial to complete IRS irs gov form 656, keep away from errors and furnish it in a timely way:

How to complete a 656?

-

On the website hosting the blank, click on Start Now and move towards the editor.

-

Use the clues to fill out the relevant fields.

-

Include your individual information and contact details.

-

Make certain that you enter suitable information and numbers in suitable fields.

-

Carefully examine the content of your blank as well as grammar and spelling.

-

Refer to Help section should you have any issues or address our Support staff.

-

Put an electronic signature on your IRS gov form 656 printable while using the assistance of Sign Tool.

-

Once the form is finished, press Done.

-

Distribute the prepared document by way of email or fax, print it out or download on your gadget.

PDF editor enables you to make adjustments in your IRS gov form 656 Fill Online from any internet linked gadget, customize it according to your needs, sign it electronically and distribute in different means.

What people say about us

E-filing forms from home - important suggestions

Video instructions and help with filling out and completing Form 656-L